THE EFFECT OF INTELLECTUAL CAPITAL AND INFORMATION MANAGEMENT STRATEGIES ON FIRM PERFORMANCE

Published 2020-12-25 — Updated on 2020-12-26

Versions

- 2020-12-26 (2)

- 2020-12-25 (1)

Keywords

- Entelektüel Sermaye, Bilgi Yönetimi Stratejisi, Küresel İnovatiflik, Firma Performansı

- Intellectual Capital Knowledge Management Global Innovativeness Firm Performance

How to Cite

Copyright (c) 2020 Business & Management Studies: An International Journal

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Abstract

- LITERATURE

1.1 RESEARCH SUBJECT

Nowadays, it is seen that the intellectual capital accumulation and knowledge management strategies of the enterprises gain much more significance in terms of organizational efficiency. Although the importance of physical assets owned by businesses continues today, the importance of information-based assets has come to the fore in the technology age. In this sense, information management is an essential and comprehensive process that includes the stages of creating, validating, presenting, distributing, and applying information. The most important of these processes is the concept of intellectual capital implicit in businesses. In today's information age, the essential power that businesses have can be defined as their intellectual capital and innovation competence level.

In the 21st century, where competition has extremely sharp results, businesses need to differentiate from their competitors and offer value-oriented products/services for their customers in order to survive. This competition between businesses has made the efficient use of information, technology, and intellectual capital resources within the enterprise a necessity. The international dimension of the economy, the need to continuously innovate, and the more use of information technologies have obliged companies to operate in an intensely competitive environment. (Sanchez and Marin, 2005). Realization of all these differentiation and value-creating products/services is only possible with innovation. When the studies in the literature are examined, it has been determined that intellectual capital components affect the business performance, and businesses that can manage information elements are more innovative (Subramaniam & Youndt, 2005; Wu et al., 2008; Darroch, 2005).

1.2. RESEARCH PURPOSE AND IMPORTANCE

Within the scope of this study, the effect of intellectual capital, knowledge management strategies, and innovation competencies of businesses on firm performance, and the mediating effects of knowledge management strategies and innovation competencies on the firm performance of intellectual capital was examined. As a result of the analysis, it has been proven that the company performance will increase depending on the increase in the intellectual capital, information management strategies, and the importance given to innovation by the enterprises.

1.3. CONTRIBUTION of the ARTICLE to the LITERATURE

As a result of the research, it has been observed that intellectual capital is effective in knowledge management strategies, knowledge management strategies affect firm performance positively, and global innovation has a full intermediary effect in this relationship. Although these enterprises make considerable efforts in using intellectual capital assets, it has been observed that these efforts do not have a significant effect on business performance.

- DESIGN AND METHOD

2.1. RESEARCH TYPE

Quantitative methods were used in this study. Partial Least Squares (PLS-Graph 3.0, Chin, 2001) approach was used to calculate the measurements and structural parameters within the structural equation model (SEM) (Chin, 1998).

2.2. RESEARCH PROBLEMS

Based on the companies included in the Technology Fast 50 2018 list published by Deloitte, the intellectual capital, knowledge management, innovation, and company performance relationship of the enterprises were analyzed.

2.3. DATA COLLECTION METHOD

The research sample, intellectually understand the value of the capital that will transform the default and intellectual capital of the value of having a knowledge management strategy, the Technology Fast 50 is selected from executives located in Turkey's fastest-growing technology companies in the 2018 list (Deloitte, 2018). First, the managers of the selected companies were contacted, and the purpose of the work was explained to them. 32 of the 50 companies interviewed agreed to participate in the study. To avoid a single source problem, at least two participants from senior or management level employees from each company participated in the survey.

2.4. QUANTITATIVE / QUALITATIVE ANALYSIS

Partial Least Squares (PLS-Graph 3.0, Chin, 2001) approach was used to calculate the measurements and structural parameters within the structural equation model (SEM) (Chin, 1998).

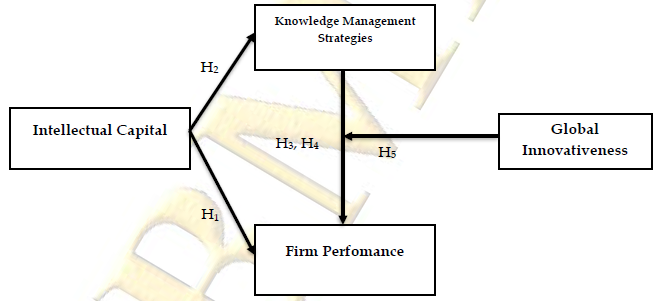

2.5. RESEARCH MODEL

3.FINDINGS AND DISCUSSION2.6. RESEARCH HYPOTHESES

H1: Intellectual capital positively affects firm performance.

H2: Intellectual capital positively affects the knowledge management strategy.

H3: Knowledge management strategy positively affects the performance of the company.

H4: Knowledge Management Strategies mediate the relationship between Intellectual Capital and firm performance.

H5: Global innovation has a moderator effect on the relationship between knowledge management strategies and intellectual capital.

3.1.FINDINGS as a RESULT of ANALYSIS

As a result of the research, it has been observed that intellectual capital is adequate on knowledge management strategies, knowledge management strategies affect firm performance positively, and global innovation has a full intermediary effect in this relationship. Although these enterprises make considerable efforts in using intellectual capital assets, it has been observed that these efforts do not have a significant effect on firm performance.

3.2. HYPOTHESIS TEST RESULTS

The findings do not provide any empirical evidence of the direct effect of intellectual capital on firm performance; H1 is not supported. However, intellectual capital has a positive effect on knowledge management strategies (= .82 p <.01) and is supported. Also, the results show that knowledge management strategies are positively associated with firm performance (= .56 p <.01), H3 is supported. To test the H4 hypothesis, that is, the hypothesis about the mediating effect of global innovation, a two-step structure procedure was applied, and H4 was supported.

3.3. DISCUSSING the FINDINGS with the LITERATURE

The most critical resource that businesses have is a qualified workforce. It is seen that intellectual capital is more effective in value creation when compared to other capital resources and intellectual capital of businesses that are strong in terms of qualified people today. One of the main reasons for this is that at the point of a company's profitability, the ability of human capital to manage all resources is the critical factor in a company's success. However, contrary to the literature (Bassi and Van Buren, 1999; Bozbura 2004; Chen et al. 2005; Phusavat et al. 2011; Zeghal et al. 2010; Yıldız 2011), it was found that intellectual capital does not have a significant effect on firm performance. Similarly, nomads and Virtue (2008) with the performance of the companies traded on the Istanbul Stock Exchange in Turkey has studied the relationship between intellectual capital; It could not detect a relationship between intellectual capital and performance. On the other hand, as a result of our analysis, it has been determined that information management strategies have a positive effect on firm performance.

4.CONCLUSION, RECOMMENDATION AND LIMITATIONS

4.1.SUGGESTIONS BASED on RESULTS

Companies that can use their knowledge management and intellectual capital effectively can see the opportunities that may arise from the external environment before their competitors and gain a competitive advantage. In line with their objectives, it is necessary to implement the necessary practices to record, protect and share the documents and information capital of the enterprises with technology, to create an organizational culture, to strengthen cooperation with suppliers, customers and vendors. In this way, businesses aim to increase their organizational performance by trying to keep customer satisfaction and loyalty at a high level.

4.2.LIMITATIONS of the ARTICLE

Each study has certain limitations. These limitations may open up new research opportunities for future studies. One of the most critical limitations of the study is the use of perceptual (subjective) performance indicators. Also, the characteristics of the firms are not included in the analysis in the study. Future studies may include control variables such as firm size, age, income level, job type, and expand the research model. Business sectors can cluster the sample to explore the differences between firms.

Downloads

References

- Barkat, W., Bech, L. S., Ahmed, A., Ahmed, R. (2018). "Impact of Intellectual Capital on Innovation Capability and Organizational Performance: An Empirical Investigation", Serbian Journal of Management, 13(2), pp: 365-379.

- Barney, J B. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99-120.

- Baron, R., David A. K (1986). “The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations,” Journal of Personality and Social Psychology, 51(6), pp:1173-1182

- Baş, M., Mısırdalı, F., Aygün, S. (2014). “Entelektüel Sermaye Alanında Yapılan Lisansüstü Tez Çalışmalarına Yönelik Bir İçerik Analizi: 2002-2012 Dönemi”, Uluslararası Yönetim İktisat Ve İşletme Dergisi, 10 (23), PP: 207-226.

- Başar, A.B., Azgın, N. (2016). “İşletme Performansının Ölçülmesinde Nakit Akış Analizlerinin Esasları Ve Borsa İstanbul Perakende Sektöründe Bir Araştırma”, Adıyaman Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 8 (23), SS: 781-804.

- Bassi, L.J., Van Burgen, M. E. (1999). "Valuing Investment In Intellectual Capital", International Journal of Technology Management", 18(5), pp: 414-432.

- Bayraktaroğlu, A. E., Çalışır, F., Başkak, M. (2019). “Intellectual Capital and Firm Performance: An Extended VAIC Model”, Journal of Intelectual Capital, 20(3), pp:406-425.

- Bolisani, E., Bratianu, C. (2017), "Knowledge Strategy Planning: An Integrated Approach to Manage Uncertainty, Turbulence, and Dynamics", Journal of Knowledge Management, 21(2), pp: 233-253.

- Bontis, N. (1998). "Intellectual Capital: an Exploratory Study that Develops Measures and Models". Management Decision, 36(2), pp: 63-76.

- Bontis, N. (1999). "Managing Organisational Knowledge By Diagnosing Intellectual Capital: Framing and Advancing The State Of The Field", International of Journal of Technology Management, 18 (5), PP: 433-462.

- Bontis, N., Keow, W.C.C., Richardson, S. (2000). "Intellectual Capital and Business Performance in Malaysian Industries", Journal of Intellectual Capital, 1 (1), PP: 85-100.

- Bozbura, F. T. (2004). "Measurement and Application of Intellectual Capital in Turkey", The Learning Organization, 11 (4/5), PP: 357-367. Doi: 10.1108/09696470410538251.

- Chen, M. C., Cheng, S. J., Hwang, Y. (2005), "An Empirical Investigation of The Relationship Between İntellectual Capital and Firms: Market Value and Financial Performance", Journal of Intellectual Capital, 6(2), pp: 159-176.

- Chen, F.C., Liu, Z.J., Kweh, Q.L. (2014). "Intellectual Capital and Productivity of Malaysian General Insurers", Economic Modelling, 36, pp: 413 – 420.

- Cheng, J. L. C. (2007). "Critical Issues in International Management Research: An Agenda for Future Advancement", European Journal of International Management, 1(1/2), pp:23-38.

- Clarke, M., Seng, D., Whiting, R. H. (2011), "Intellectual Capital and Firm Performance in Australia", Journal of Intellectual Capital, 12(4), pp:505-530.

- Çalışkan A, Akkoç İ., Turunç, Ö. (2011). “Örgütsel Performansın Artırılmasında Motivasyonel Davranışların Rolü: Yenilikçilik Ve Girişimciliğin Aracılık Rolü”, Süleyman Demirel Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 16 (3), SS: 363-401.

- Darroch, J. (2005). "Knowledge Management, Innovation and Firm Performance", Journal Of Knowledge Management, 9(3), pp: 101-115.

- Davila, G., Varvakis, G., North, K. (2019). "Influence of Strategic Knowledge Management on Firm Innovativeness and Performance", Brazilian Business Review, 16(3), pp:239- 254.

- Deloitte. (2018). "Technology Fast 50 2018 listesi", https://fast50.deloitte.com.tr/winner-reports.aspx Erişim Tarihi:10.02.2020

- Diez, J. M., Ochoa, M. L., Prieto, M. B., Santidrian, A. (2010). "Intellectual Capital and Value Cretion in Spanish Firms", Journal of Intellectual Capital, 11(3), pp:348-367.

- Edvinsson, L., Sullivan, P. (1996), "Developing A Model For Managing Intellectual Capital", European Management Journal, 14(4), pp: 356-364.

- Elberdin, M. B., Saenz, J., Kianto, A. (2018). "Knowledge Management Strategies, Intellectual Capital, and Innovation Performance: A Comparison Between High-and-Low Firms", Journal of Knowledge Management, 22(8), pp: 1757-1781.

- Erdem, Z. (2007). “Entelektüel Sermayenin Küresel Ekonomideki Yeri ve Önemi”, Sosyal Siyaset Konferansları Dergisi, 53, SS: 275-294.

- Fornell, C., Larcker, D. F. (1981), “Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics”, Journal of Marketing Research, 18(3), pp:382- 388

- Göksel, A. B., Baytekin, E. P. (2008). “Bilgi Toplumunda İşletmeler Açısından Önemli Bir Zenginlik: Entelektüel Sermaye – Halkla İlişkiler Perspektifinden Bir Değerlendirme- “, İstanbul Üniversitesi İletişim Fakültesi Dergisi, 31, SS: 81-98.

- Grant, R.M. (1996). "Toward a Knowledge-Based Theory of The Firm", Strategic Management Journal, 17(2), pp: 109-122.

- Guthrie, J., Ricceri, F., Dumay, J. (2012). "Reflections and Projections: A Decade of Intellectual Capital Accounting Research", The British Accounting Review, 44(68), pp: 68–82.

- Hamdan, A. (2017). "Intellectual Capital and Firm Performance", International Journal of Islamic and Middle Eastern Finance and Management, 11(1), pp:139-151.

- Hermans, R., Kauranen, I. (2005). "Value Creation Potential of Intellectual Capital in Biotechnology: Empirical Evidence From Finland", R&D Management, 35(2), pp: 171-185.

- Hernandez, A. J. C., Jimenez, D. (2016). "Knowledge Management, Flexibility and Firm Performance: The Effects of Family Inbolvement", European Journal of Family Business, 6, pp: 108-117.

- Horasan, E., Meydan, C., Yıldız, S. (2017). “Entelektüel Sermaye, Kurumsal Yönetim Derecelendirme Notu ve İşletme Performansı Arasındaki İlişkiler Üzerine Bir Araştırma”, Kafkas Üniversitesi İktisadi ve İdari Bilimler Fakültesi, 8 (16), SS: 463-482.

- Howell, J.M., Avolio, B.J. (1993). “Transformational Leadership, Transactional Leadership, Locus of Control, and Support for Innovation: Key Predictors of Consolidated-Business-Unit Performance”, Journal of Applied Psychology, 78, pp:891.

- Hsu, I., Sabherwal, R. (2012). “Relationship Between Intellectual Capital and Knowledge Management: An Empirical Investigation”, Decision Sciences, 43(3), pp:489-524.

- Hussinki, H., Ritala, P., Vanhala, M., Kianto, A. (2017). "Intellectual Capital, Knowledge Management Practices and Firm Performance", Journal of Ontellectual Capital, 18(4), pp: 1469-1930.

- Kanıbir, H. (2004). “Yeni Bir Rekabet Gücü Kaynağı Olarak Entellektüel Sermaye ve Organizasyonel Performansa Yansımaları”. Havacılık ve Uzay Teknolojileri Dergisi, 3(1), ss: 77-85.

- Kaya, S. (2017). “İşletmelerde Entelektüel Sermaye ve Bilgi Yönetiminin İnovasyon Performansı ve Rekabet Avantajı Üzerine Etkilerinin Belirlenmesi”, Haliç Üniversitesi Sosyal Bilimler Enstitüsü Doktora Tezi, İstanbul.

- Kaplan, R. S. (2004), "Measuring the Strategic Readiness of Intangible Assets", Harvard Business Review, https://hbr.org/2004/02/measuring-the-strategic-readiness-of-intangible-assets (Date of Access: 21.01.2020).

- Kianto, A., Andreeva, T. (2014). "Knowledge Management Practices and Results in Service-Oriented Versus Product-Oriented Companies", Knowledge and Process Management, 21(4), pp:221-230.

- Kleijnen, M., de Ruyter, K., Wetzels, M. (2007). “An assessment of value creation in mobileservice delivery and the moderating role of time consciousness”, Journal of Retailing, 83(1), pp:33-46.

- Lev, B. (2004), "Sharpening the Intangibles Edge", Harvard Business Review, https://hbr.org/2004/06/sharpening-the-intangibles-edge (Date of Access: 21.01.2020).

- Ling, Y.H. (2013). "The Influence of Intellectual Capital on Organizational Performance-Knowledge Management as Moderator". Asia Pacific Journal Management, pp: 937-964.

- MacKinnon, D. P., Lockwood, C. M., Hoffman, J. M., West, S. G., Sheets,V. (2002). “A comparison of methods to test mediation and other interveningvariable effects”, Psychol. Methods 7, pp:83–104

- Marr, B., Gray, D., Neely, A. (2003), "Why Do Firms Measure Their İntellectual Capital?", Journal of Intellectual Capital, Vol. 4 No. 4, pp. 441-464.

- Mehralian, G. (2013). "Prioritization of Intellectual Capital Indicators in Knowledge-Based Industries: Evidence From Pharmaceutical Industry", International Journal of Information Management, 33 (1), PP: 209-216.

- Meutcheho, J. P. (2016), A Mixed Methods Analysis of Professionals' Perceptions of the Impact of Sustainable Supply Chain Management on Company Performance, Yayınlanmamış Doktora Tezi, Lawrence Technological University, USA.

- Nahapiet, J., Ghoshal, S. (1998). "Social Capital, Intellectual Capital, and The Organizational Advantage". Academy of Management, 23(2), 242-266.

- Nimtrakoon, S. (2015). "The Relationship Between Intellectual Capital, Firms' Market Value and Financial Performance: Empirical Evidence From The ASEAN", Journal of Intellectual Capital, 16 (3), PP: 587-618.

- OECD (2013), "Supporting Investment in Knowledge Capital", Growth and Innovation, OECD Publishing. http://dx.doi.org/10.1787/9789264193307-en.

- Özdemir, Z. T. (2019). “Entelektüel Sermaye ve Bilgi Yönetiminin Örgütsel Performansa Etkileri: X Holding’inde Bir Araştırma”, Çanakkale Onsekiz Mart Üniversitesi Sosyal Bilimler Enstitüsü Yüksek Lisans Tezi, Çanakkale.

- Phusavat, K., Comepa, N., Sitko-Lutek, A., Ooi, K.B. (2011), "Interrelationships Between İntellectual Capital And Performance: Empirical Examination", Industrial Management & Data Systems, 111(6), pp. 810-829.

- Roos, G., Roos, J. (1997). "Measuring Your Company's Intellectual Performance". LRP, 30(3), 413-426.

- Sanchez, A., Marin, G. (2005). "Strategic Orientation, Management Characteristics and Performance: A Study of Spanish SEMs", Journal of Small Business Management, 43(3), pp: 287-308.

- Serenko, A., Bontis, N. (2013). "Investigating The Current State and Impact of The Intellectual Capital Academic Discipline", Journal of Intellectual Capital, 14(4), pp:1469-1930.

- Sönmez, R., Kasımoğlu, M. (2014). “Sürdürülebilir Rekabet Avantajının Kaynağı: Endüstri Temelli Teori ve Kaynak Temelli Teori Çerçevesinde”, İstanbul Ticaret Üniversitesi Sosyal Bilimleri Dergisi, 25, SS: 63-90.

- Stewart, T. (1997). Entelektüel Sermaye: Kuruluşların Yeni Zenginliği, (Çev. Elhüseyni, N.), BZD Yayıncılık, İstanbul.

- Subramaniam, M., Youndt, M. A. (2005). "The Influence of Intellectual Capital On The Types Of Innovative Capabilities", Academy of Management Journal, 4883), pp:450-463.

- Şen, H. (2020). “Entelektüel Sermaye ve Firma Performansı”, Eskişehir Anadolu Üniversitesi Sosyal Bilimler Enstitüsü, Yüksek Lisans Tezi, Eskişehir.

- Tan, H.P., Plowman, D., Hancock, P. (2007), "Intellectual Capital And Financial Returns Of Companies", Journal of Intellectual Capital, 8(1), pp. 76-95.

- TDK (2020). Türk Dil Kurumu Sözlüğü, www.sozluk.gov.tr (Erişim Tarihi: 26.10.2020)

- Tenenhaus, M., Vinzi, V. E. (2005). “Pls regression, pls path modeling and general-ized procrustean analysis: a combined approach for multiblock analysis”, Journal of Chemometrics, 19(3), pp:145–153

- Torres, M.R. (2006). "A Procesure to Design a Structual and Measurement Model of Intellectual Capital: An Exploratory Study", Informatin & Management, 43, PP: 617-626.

- Tsan, W.N., Chang, C.C. (2005). "Intellectual Capital System Interaction in Taiwan", Journal of Intellectual Capital, 6 (2), PP: 285-298.

- Turgut, O. (2014). “Entelektüel Sermaye Üzerinde Kalite Yönetim Sistemi Uygulamalarının Finansal Etkisi: Borsa İstanbul’a (BİST) Kote Olan Şirketler Üzerinde Bir Uygulama”, Sakarya Üniversitesi Sosyal Bilimler Enstitüsü Doktora Tezi, Sakarya.

- Turunç, Ö. (2016). “Bilgi Teknolojileri Kullanımının İşletmelerin Örgütsel Performansına Etkisi Hizmet Sektöründe Bir Araştırma”, Toros Üniversitesi İktisadi İdari Bilimler Fakültesi Dergisi, 3 (5), SS: 225-247.

- Uzay, Ş., Savaş, O. (2003). “Entelektüel Sermayenin Ölçülmesi: Mobilya Sektöründe Karşılaştırmalı Bir Uygulama Örneği”, Erciyes Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 20 (1), PP: 163-181.

- Wu, I. L., Chen, J. L. (2014). "Knowledge Management Driven Firm Performance: The Roles of Business Process Capabilities and Organizational Learning", Journal of Knowledge Management, 18(6), pp: 1141-1164.

- Wu, W.Y., Chang, M.L, Chen, C.W. (2008). "Promoting Innovation Through The Accumulation of Intellectual Capital, Social Capital and Entrepreneurial Orientation", R&D Management, 38(3), pp: 265-277.

- Yağmurlu, N. (2018). “İmalat Sanayiinde Stratejik Maliyet Yönetimi Uygulamaları Ve İşletme Performansı Üzerindeki Etkileri”, Süleyman Demirel Üniversitesi Sosyal Bilimler Enstitüsü, Doktora Tezi, Isparta.

- Yalama, A., Coşkun, M. (2007)." Intellectual Capital Performance of Quoted Banks On The İstanbul Stock Exchange Market", Journal of Intellectual Capital, 8(2), PP: 256-271.

- Yıldız, S. (2010). “İşletme Performansının Ölçümü Üzerine Bankacılık Sektöründe Bir Araştırma”, Erciyes Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 36 (1), SS:179-193.

- Yıldız, S. (2010b). Entelektüel Sermaye: Teori ve Araştırma. Türkmen Yayınevi, İstanbul.

- Yıldız, S. (2011). “Entelektüel Sermayenin İşletme Performansına Etkisi: Bankacılık Sektöründe Bir Araştırma”, Anadolu Üniversitesi Sosyal Bilimler Dergisi, 11 (3), SS: 11-28.

- Youndt, M.A., Subramaniam, M. and Snell, S.A. (2004), "Intellectual capital profiles: an examination of investments and returns", Journal of Management Studies, Vol. 41 No. 2, pp. 335-361.

- Yörük, N., Erdem, M. S. (2008). “Entelektüel Sermaye ve Unsurlarının, BİST’de İşlem Gören Otomotiv Sektörü Firmalarının Finansal Performansı Üzerine Etkisi”, Atatürk Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 22 (2), SS: 397-413.

- Zeghal, D., Maaloul, A. (2010), "Analysing Value Added As An ındicator of İntellectual Capital And İts Consequences On Company Performance", Journal of Intellectual Capital, 11(1), pp: 39-60.